When the global economy came screeching to a halt early in 2020 due to the COVID-19 pandemic, policy makers turned to Central Banks to alleviate the economic pain. This month historian Simon Bytheway looks at the history of central banking and asks hard questions about the risks involved in the policies they have pursued.

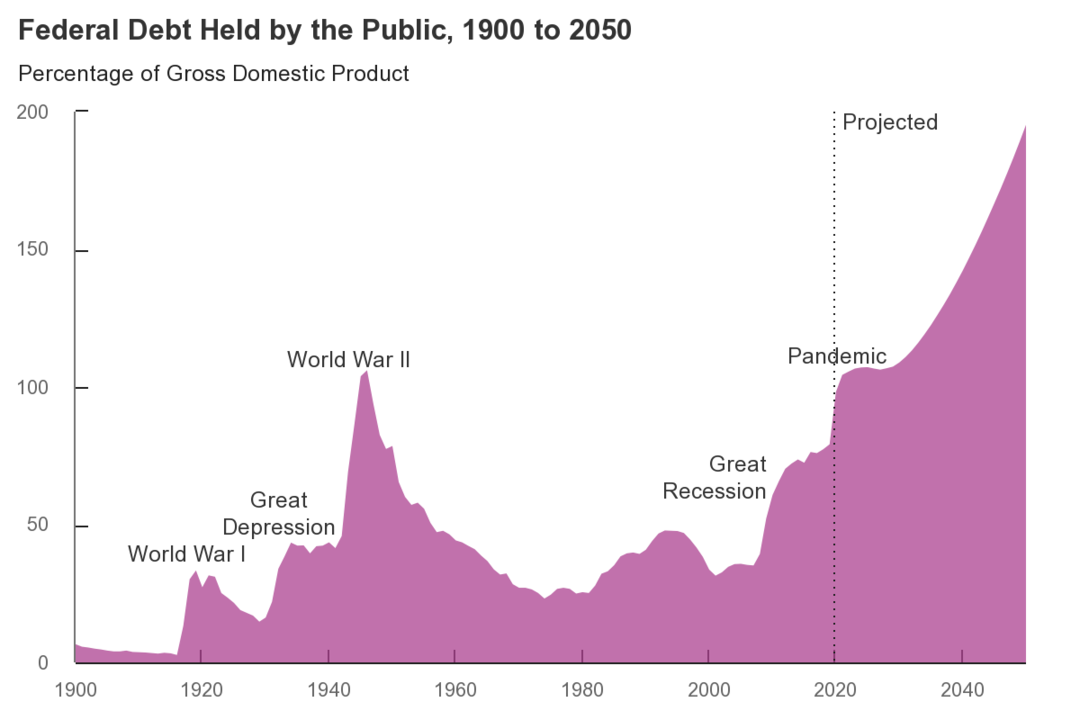

At the end of 2020, the U.S. government’s debt roughly equaled the size of the entire American economy for the first time since World War II. This dubious milestone deserves much more attention.

The national debt exploded as the result of ongoing federal spending to prop up the economy during the COVID-19 crisis. But the swelling of debt began well before the virus.

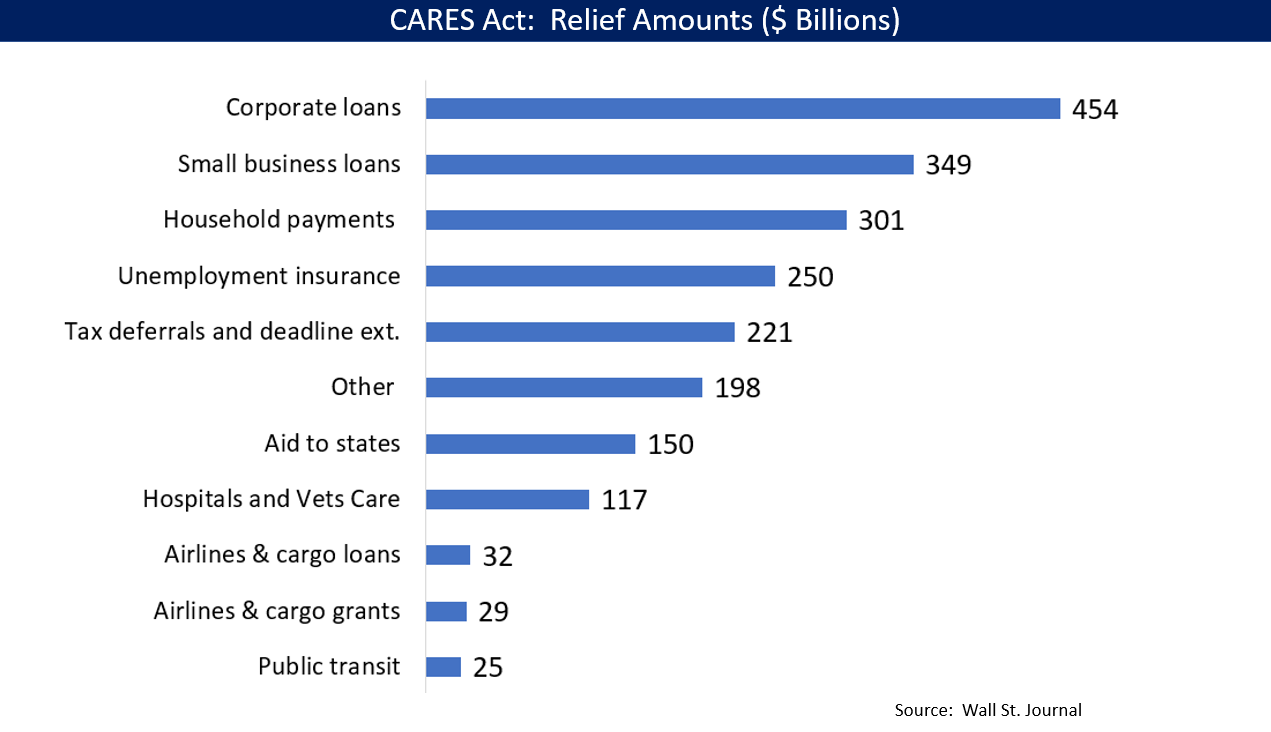

In 2008, six of America’s leading financial institutions received $8.2 trillion in “lifesaving support” and just before the onset of the COVID-19 virus (late September 2019) an additional $3 trillion was pumped into “unnamed trading houses on Wall Street” by the Federal Reserve Bank of New York (FRBNY) with Federal Reserve System authorization.

We are living in a world “awash in debt,” a financial construct that the world’s central banks have authorized and backed with all the credit and trust they have been able to muster.

Since the global financial crisis of 2008, new economic thinking on the right and on the left has, for different reasons, suggested that global indebtedness is no longer a pressing economic problem. Older historical thinking, however, suggests the opposite: that nation states, just like kingdoms and empires, flounder and fail when they have chronic and enormous obligations. Debt is a social and political problem.

With each nation having its own central bank—a bank of government in charge of issuing its own national currency, a bank of banks that weighs up the wealth of the nation, and a bank at the very creation of credit and debt in the national economy—it would serve us well to know something of their history.

When, where, and why were central banks created? What role have these banks played historically in the growth of national economies, and how has that role changed over time?

We might also ask: how successful have central banks been in alleviating financial crises during previous episodes of national and international emergency, and what they can do to get us out of our present socioeconomic malaise?

The Genesis of Central Banking

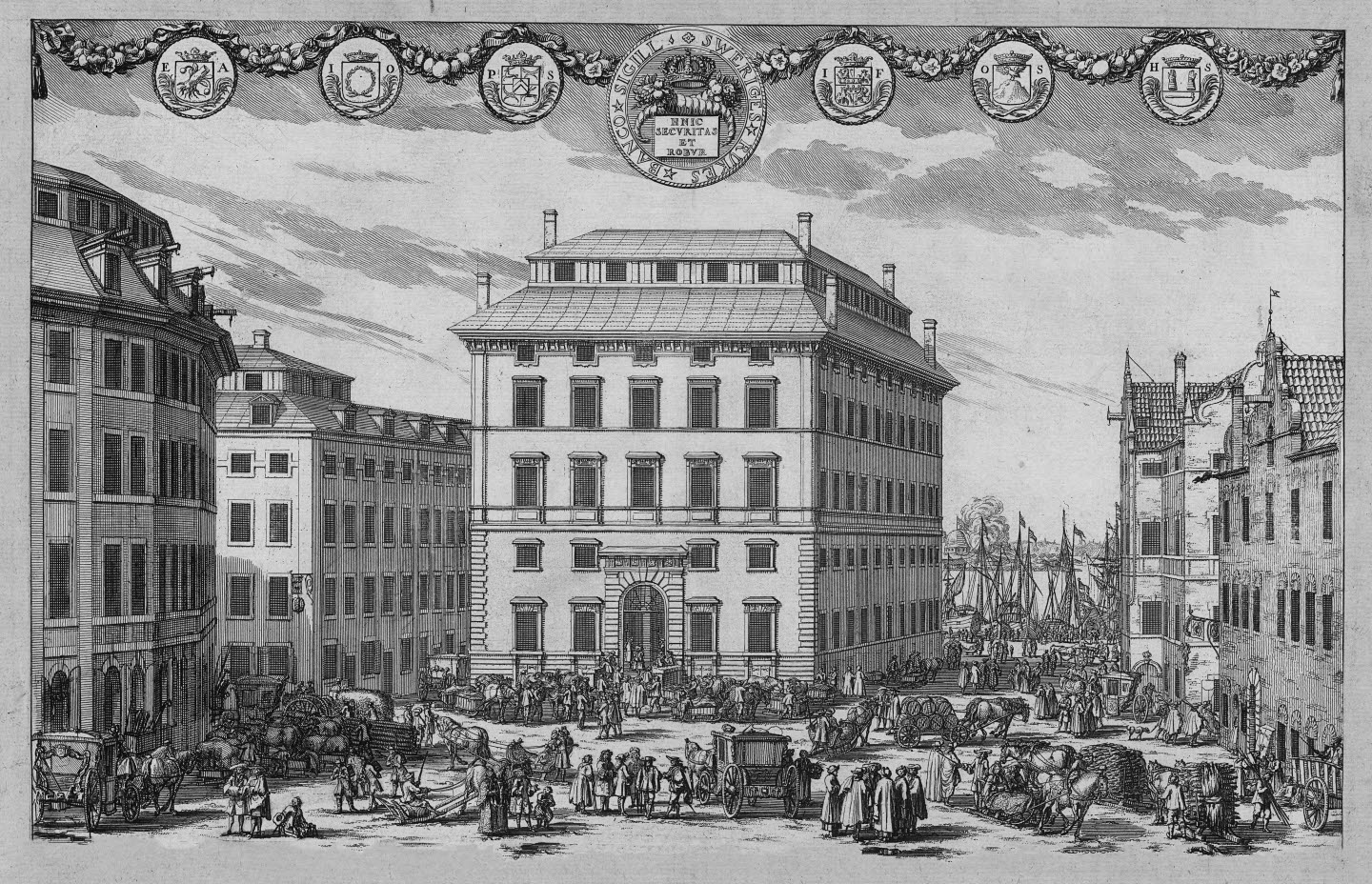

The Riksbank of Sweden claims to be the world’s first central bank. It was founded by the Swedish parliament in 1668 as a government bank in order to separate it from the scandalous collapse of a commercial bank that had strong financial links to the king. Nevertheless, the Riksbank operated in much the same way as any other private bank and only became a central bank in the modern sense of the word sometime in the years after the First World War.

The distinction of being the archetypal central bank, therefore, falls to the Bank of England, the world’s second oldest central bank, chartered in 1694 to quickly raise loans for the Royal Navy.

From the outset it was the “government’s bank,” exclusively privileged to handle government finances. Its business practices evolved in a long, slow process punctuated by periods of rapid change. Through four key operational innovations, the Bank of England attempted to position itself at the heart of British finance and economy as a highly specialized financial institution, doing things that no other bank could do.

One crucial way in which the Bank of England differentiated itself from earlier generations of commercial banks was by ensuring that its own banknotes circulated freely. They commanded maximum possible legitimacy by being convertible to a silver or gold equivalent, with the “promise to pay the bearer on demand” clearly printed on the back. The paper notes of competing commercial banks were collected and immediately withdrawn from circulation, granting the Bank of England an effective monopoly on issuing notes.

Sealing of the Bank of England Charter (1694) an illustration by Lady Jane Lindsay from 1905.

In this way, the Bank of England not only consolidated its own holdings of precious metals but encouraged the circulation of its own money in the form of banknotes and coinage. These circulated first in London, then across the whole of England, and ultimately throughout the British Empire and beyond. Moreover, the bank’s freely convertible paper currency—the pound sterling—was as “good as gold” once Great Britain adopted the gold standard in 1844.

Having established itself as a “bank of issue,” the Bank of England became increasingly involved in the maintenance and supervision of London’s ever-growing financial markets through what it called “open market operations.”

The timing of the extension of credit to key market players, or conversely its sudden withdrawal, shaped how financial markets, investors, and institutions responded to the commercial and economic events of the day.

From its very beginning, the Bank of England had the exclusive right to sell government debt, and through these core banking operations the bank increasingly decided the “price of money”—the interest rates—of transactions creating debt and credit in London’s financial markets.

A one-pound sterling banknote issued in London from 1805.

Owing to prompt, short-term transfers of money on the market and extremely long-term financing of government debts, the Bank of England emerged as the one bank that effectively set the minimum lending rate across the entire economy. All other banks and financial institutions set their own interest rates in constant reference to what (until 1972) was simply referred to as “Bank rate.”

The innovation of a centrally controlled minimum rate for lending enabled the Bank of England to become what we would now recognize as the lender of last resort. In effect, it had become the “bank of banks” in that any financial institution facing difficulties could turn to it for “assistance” in times of trial.

If the financial problems caused by an insolvency were sufficiently dire and posed sufficiently pressing political problems for the government of the day, the Bank of England would be requested to find and supply an emergency extension of funds, providing “liquidity” in the form of a “bailout” solution. Uniquely placed between the nation’s banks and government, the Bank of England thus stood at the very center of markets and money creation.

Other nations, despite initial misgivings and long, cautious indecision, were sufficiently impressed by the Bank of England’s performance in the 18th century that they set out to establish their own central banks in the “long” nineteenth century: the Bank of France in 1800, the Bank of the Netherlands in 1814, the Bank of Austria in 1817, the National Bank of Belgium in 1850, the Reichsbank of the newly federated Germany in 1875, the Bank of Japan as the first non-European central bank in 1882, the Bank of Italy in 1893, and the Bank of Taiwan in 1899, which along with the Bank of Korea, re-chartered in 1911, controlled the finances of Japan’s colonies.

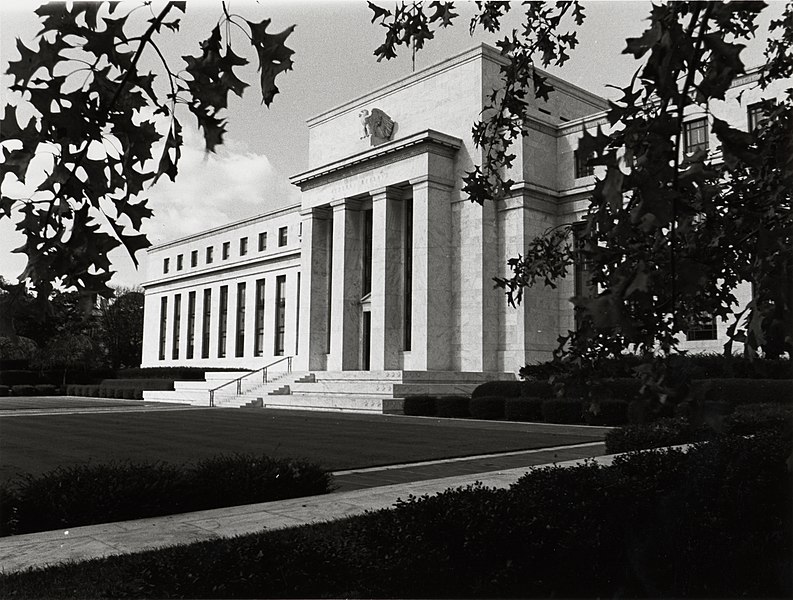

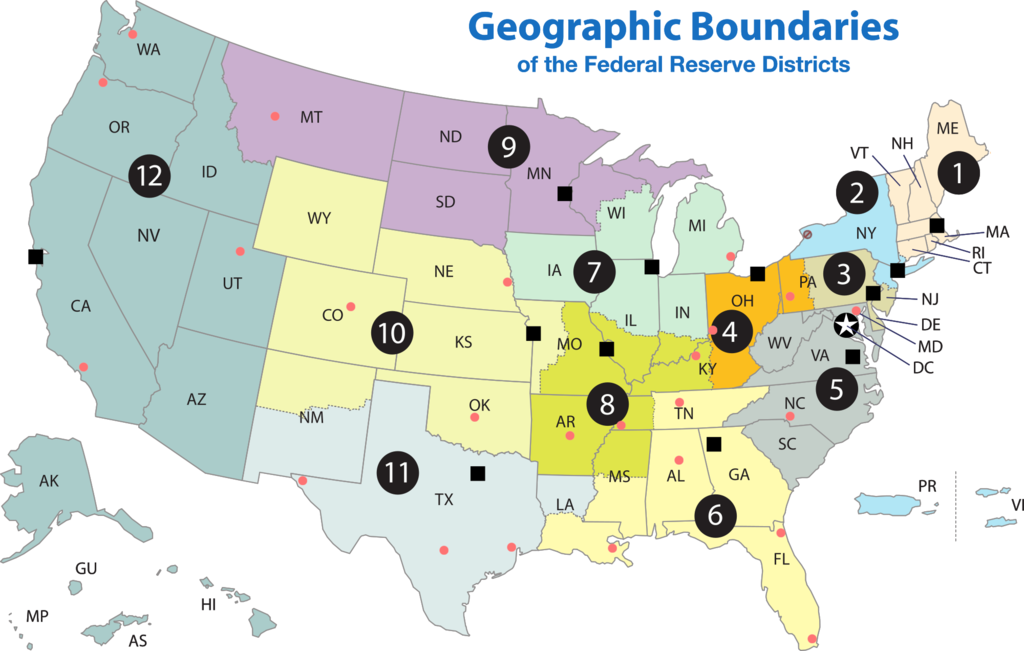

American exceptionalism, at least in the worlds of banking and finance, ended with legislation founding the Federal Reserve System of 12 regional reserve banks in December 1913, and with the establishment of the Federal Reserve Bank of New York in November 1914 as the first among equals.

Somber banking texts warn us that it is misleading to read too much into the dates, but students of history cannot help but notice the timing and context here: America’s financial system got its own central bank just after the outbreak of the first global war in Europe.

World War I and the Rise and Globalization of Central Banks

The First World War is often characterized as bringing down the curtain on the first great age of modern globalization, but for historians of central banks the opposite is true: financial globalization intensified throughout the 1920s, partly as result of cooperation brought about by the war.

On July 31, 1914, the Governor of the Bank of England, Walter Cunliffe, went to the Treasury offices to see Chancellor of the Exchequer David Lloyd George and his senior officials, and with tears in his eyes said: “Keep us out of it. We shall be ruined if we are dragged in!” It was clear to those in the know that the coming war threatened the very basis of European prosperity, and something had to be done about it.

The Bank of England immediately set about organizing an international network of central banks to cope with the new realities of wartime finance, such as emergency lending and embargoes on the free export of gold. Applying central-banking techniques that it had developed previously for use with domestic banks, the Bank of England facilitated direct, in-house transactions between authorized central banks allowing for the quick remittance of funds without having to use banknotes or coins.

Emergency wartime arrangements were also extended to facilitate foreign exchange, trade, and the custody holding of valuables (especially gold), all free of charge. Actually, by avoiding the physical use and movement of currency, and by restricting the unit of settlement to the pound sterling, these Allied central banks were supporting credit creation by the Bank of England.

It also increased the speed of transactions and reduced the risks of loss. These new forms of inter-central bank cooperation were formalized and deepened during the war. In 1916, direct telegraph links connected the governors of the central banks, allowing for a greater informational exchange in commercial intelligence, and culminated in new kinds of financial agreements. Eventually 17 central banks would hold national accounts at the Bank of England in London.

What started out as a series of simple British initiatives ended with the United States effectively financing the Allied war effort. By the war’s end, New York was the undisputed capital of capital and the Federal Reserve Bank of New York—America’s central bank—was at the center of all things financial.

Benjamin Strong Jr. was the Governor of the Federal Reserve Bank of New York from 1914-1928 (left). The seal of the Federal Reserve Bank of New York (right).

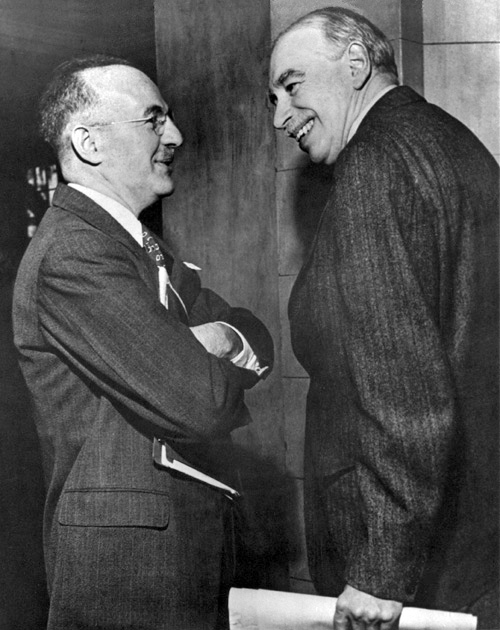

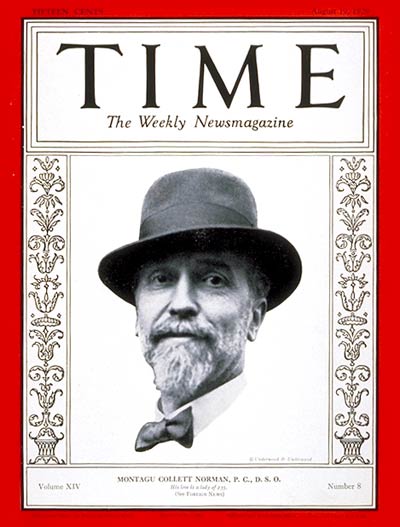

Its governor, Benjamin Strong Jr., working closely with the governor of the Bank of England, Montagu Norman, set out to imagine a new program of global financial governance led by their own preeminent, and privately owned, central banks.

The two governors strongly advocated that central banks should maintain their operational independence while doing the business of their elected governments. Central banks should “recognize the importance of international as well as national interests” by always cooperating with one another and coordinating their foreign banking operations.

Seemingly antithetical to the popular demands of the postwar era, in which new central banks were established by governments with expressly democratic aims, the 1921-1931 campaign to establish new “independent” central banks was remarkably successful.

The modern-day headquarters of the Bank of International Settlements (BIS) in Basel, Switzerland.

In particular, the newly independent republics that emerged in Central and Eastern Europe as a result of the First World War were keen to cooperate with international partners and join the emerging club of central banks.

The program of global financial governance, led by Strong and Norman, culminated with the establishment of the Bank of International Settlements (BIS) in May 1930 as a bank that “fosters international monetary and financial cooperation and serves as a bank for central banks” [italics mine].

The globalization of independent central banks and finance advanced in an unprecedented way during the 1920s. The boom in international lending and a surge of credit creation, now also centered firmly on New York, was followed by a global financial crisis in 1929, an international debt-default crisis in the early 1930s, and great banking crises in many countries, including Austria, Germany, and the United States.

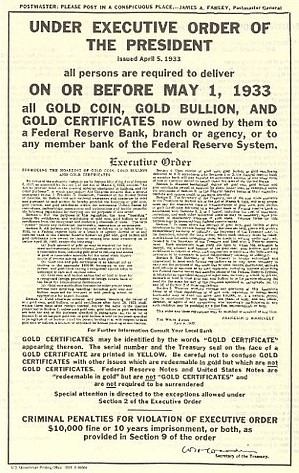

The charges against the central banks for allegedly causing the Great Depression do not need to be re-prosecuted here. Suffice it to say the United States’ long, calculated abandonment of the gold standard, completed on June 5, 1933, was preceded by mass unrest and the humiliating failure of the gold standard in Great Britain on September 21, 1931.

It was also preceded by Japan’s violent turn towards China—and against the international liberalism of its erstwhile creditors—engendered partly by the scandalous collapse of Japan’s own gold standard on December 13, 1931.

The international monetary system, meaning also the international system of trade credits and payments, radically disintegrated. And now, practically as an afterthought, central bank cooperation, which had taken on a highly significant role in the 1920s, fell into abeyance.

From Bretton Woods to Wall Street

As in the first global conflict of 1914-1918, war was preceded by the (re)configuration of emergency financial arrangements between the central banks (and governments-in-exile) in 1939, and finished with the United States effectively financing the Allied war effort.

The Bretton Woods system established in July 1944—and the institutions it generated, the International Monetary Fund (IMF) and the World Bank—aimed to restore international financial and monetary cooperation.

Trade liberalization and multilateralization programs led to creation of the European Payments Union (EPU) in 1950, which administered Marshall Plan funds provided by the U.S. government for Western Europe. Incidentally, the European Payments Union threw the Bank of International Settlements (BIS) a lifeline by employing it to manage its banking operations throughout the 1950s.

Missing from these new international institutions—and seemingly extraneous to them—were Europe’s great central banks.

There was more financial diplomacy than ever, but it was now led by diplomats and politicians, such as finance ministers and their deputies, using public monies. The age of private financiers and banking ambassadors had emphatically been brought to an end by these new international institutions and organizations.

Central banking was now about maintaining fixed exchange rates, particularly in relation to the U.S. dollar (USD), and for the FRBNY to keep the dollar convertible to gold at $35 per troy ounce.

Central bank cooperation extended to supporting the pound, dollar, and other currencies right through into the 1970s, and included the establishment of the Gold Pool in 1961, but fell way short of what it had been in the days of the governors Norman and Strong.

Indeed, a century after the statesmen of haute finance attempted to use their central bank policies to shape the emerging global economy, their successors, by contrast, like to describe themselves as humbly as “technicians” and “administrators.”

Under the first Reagan administration, firm in its commitment to the “magic of the market” and railing against intervention in exchange rate and foreign monetary issues, the perceived importance of central banking reached a nadir.

By the early 1990s, the Bretton Woods system of fixed exchange rates, and the long, postwar economic boom it had engendered, had ended everywhere—even in Japan.

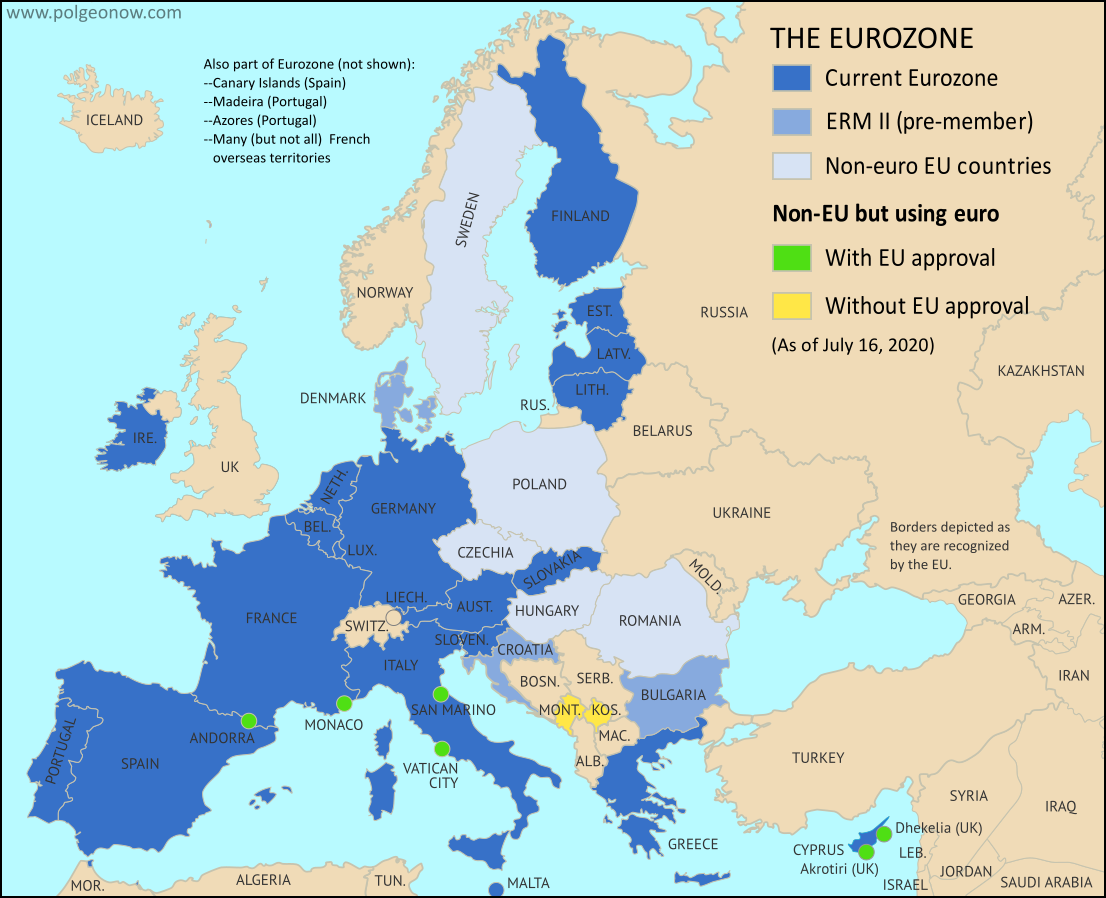

Yet the combination of the surge in use of credit cards and electronic monies, new financial products, financial deregulation on a global scale, and the return of big international financial conferences, such as the Plaza Accord of 1985, the Louvre Accord of 1987, and the European Monetary Unification (EMU) in 1992 re-empowered the central banks.

Of course, the creation of a new European currency, and the de-monetization of national currencies, could only proceed with renewed central bank cooperation; for the authority to designate and validate monetary claims is at the very heart of what central banks do.

Central Banks, 2008, and Covid-19

The Global Financial Crisis in 2008 allowed the central banks to reposition themselves at the center of the international political economy when they made a series of extraordinary purchases of debt claims held by private banks. The magnitude of these “asset purchases” is difficult to grasp, but the Federal Reserve Bank of New York’s holding of what were euphemistically called “policy assets” increased by more than 4,000 percent during the last four months of 2008.

Many of these operations remain shrouded in secrecy, but the scale of emergency lending dressed up and accounted for as “asset purchases” was enormous. More than six years after these emergency measures were first introduced, the Federal Reserve Bank of New York continued to buy “unwanted” (read, “commercially worthless”) assets called “mortgage-backed securities (MBSs)” from private banks.

In effect, commercially private assets were turned into public debt at the rate of billions per month, with its lending operations totaling in excess of $4 trillion for fiscal 2014. According to the metrics on its own balance sheet, the Federal Reserve Bank of New York had become the largest bank in the world.

Moreover, owing to its remarkable accumulation of commercially “toxic” mortgage-backed securities, the Federal Reserve Bank of New York had also become one of the world’s largest landlords.

None of these new developments has a place in central-banking theory; and narrow theorizing about central-banking practice cannot begin to capture the wider socioeconomic effects and implications of these financial changes.

All around the world, other central banks followed the American example by purchasing worthless “assets” from private banks, often after having received the assurance of unlimited credit facilities from the U.S. Federal Reserve System.

Central banks’ interest rates fell to the lowest levels ever in their histories, following the example of the Bank of Japan’s own emergency, post-bubble experiment with ultra-low or zero interest rates, which lowered lending costs across the global economy.

You might be excused for imagining that entrepreneurs have been lining up for big loans ever since (especially if you listened to your economics teacher in high school). On the contrary, investment has stalled as money is increasingly deposited in safe havens.

Tellingly, just as gold prices soared to historic highs in the months and years after the Global Financial Crisis of September 2008, the onset of the global COVID-19 pandemic has once again fueled gold purchases with the gold price rising to approximately the same levels today.

A chart showing gold prices between 1973 and 2013.

Indeed, we were still living with the barely studied consequences of the financial crisis of 2008 when the novel coronavirus appeared.

Any attempt to address the question of what central banks can do to help us cope with the present COVID-19 pandemic and its economic and financial consequences must start by acknowledging the extent to which the present situation is a carryover from the response to the global financial crisis of 2008.

Owing to ongoing coronavirus effects, U.S./China trade tensions, and widespread disruption to global supply chains, we are now in what John Maynard Keynes might have described as a “very tight spot” where the global economy has been brought to something analogous to a sudden, “tight” stop.

Societies and economies have not experienced anything similar since the early days of the First World War. Just like those dreadful events of over a century ago we are seeing an enormous surge in credit creation with ubiquitous and massive debts presented as the “policy assets” of central bank liquidity.

In a sense, we are where we are today because the world’s central bankers acted not according to principles or policy (in direct contrast to the bank governors of the 1920s), but pragmatically, stumbling into a series of ad hoc, emergency experiments in rapid debt relief.

This may impart a positive spin on the situation, but what it actually means, in many cases, is deeply disturbing.

In effect, the very same private banks that caused the financial crisis of 2008 in the first place have benefited from the extraordinary transfer of public funds to them. This transfer has occurred despite nominal government control over the central banks, apparently free of charge, and without their being held to account for their own private actions.

The upshot is a world in which a small number of individuals appear to own more than half of the world’s wealth. Barriers to open, accountable functioning in this institutional field are great, and the challenges to its original democratic mission are even greater.

Nevertheless, we must do better. We must demand that central banks serve public, rather than private, interests if we are to experience anything like the high, inclusive, sustainable economic growth that all governments should want for the future of their people.

The Debts of Our Children

In 1948, looking back over his 24-year career as governor of the Bank of England, Lord Montagu Norman was unsparingly critical of himself and his generation of central bankers, writing that “it now seems that, with all the thought and work and good intentions which we provided, we achieved absolutely nothing… . By and large nothing that I did, and very little of what old Ben did, internationally produced any good effect—or indeed any effect at all except that we collected money from a lot of poor devils and gave it over to the four winds.”

The “poor devils” of today should know that the wealth of their nations will not be scattered to the winds. Rather, they should fear that the once-inviolable “banks of banks” will deliver it into the hands of elite, private institutions whose so-called “financial products” saddle the meek of the world with poverty through the creation of new forms of unfathomable debt.

A seemingly unstoppable process is upon us, a huge transfer of wealth led by the central banks and distinguished by an enormous national socialization of debt, while at the same time, sources of international wealth remain privatized.

The U.S. government’s national deficit for the first nine months of the present budget year, which began on October 1, 2019, totaled $2.74 trillion. In the month of June 2020 alone, the national deficit was $864 billion; greater than the corresponding totals of $665 billion and $779 billion for the entire fiscal years of 2017 and 2018 respectively.

Most alarmingly, the present budget deficit is well on its way to more than doubling the worst recorded deficit of $1.4 trillion for fiscal 2009, the year in which the U.S. government reckoned with the consequences of the global financial crisis of 2008. A new financial crisis of unprecedented magnitude is evolving now, right in front of our eyes.

We must ask: is it morally acceptable that future generations be burdened with the debts of unprincipled U.S. government administrations for the coming centuries?

Real, lived experiences from developing countries show that chronic and enormous debt burdens are corrosive to the social fabric of a nation in ways that we are only beginning to understand, and often accompanied by specters such as chronic inflation, hyper-inflation, fascism, and war.

As inequalities in wealth and opportunity increase, civil unrest and social tensions are heightened, often to the point that government is effectively unable to function. Historians and other social scientists are right to be wary of debt: centuries’ worth of historical evidence warns us against it.

Liaquat Ahmed. 2009. Lords of Finance: The Bankers Who Broke the World. New York: Penguin.

Simon James Bytheway. 2014. Investing Japan: Foreign Capital, Monetary Standards, and Economic Development, 1859–2011. Cambridge, MA: Harvard University Press.

Simon James Bytheway & Mark Metzler. 2016. Central Banks and Gold: How Tokyo, London, and New York Shaped the Modern World. Ithaca: Cornell University Press.

Eric Helleiner. 2014. The Status Quo Crisis: Global Financial Governance After the 2008 Financial Meltdown. Oxford: Oxford University Press.

Mark Metzler. 2013. Capital as Will and Imagination: Schumpeter’s Guide to the Postwar Japanese Miracle. Ithaca: Cornell University Press.

Adam J. Tooze. 2018. Crashed: How a Decade of Financial Crises Changed the World. New York: Viking.